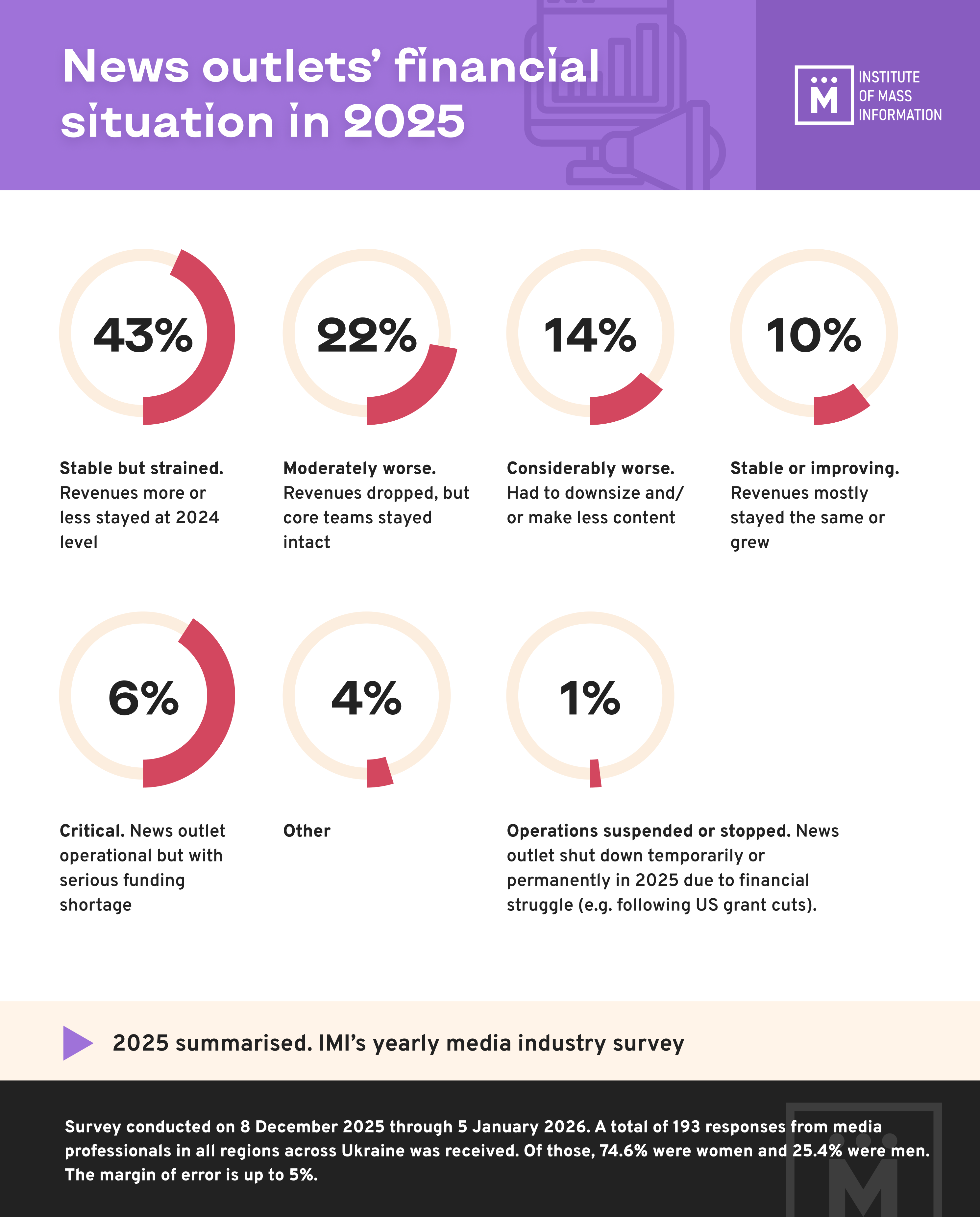

43% of Ukrainian media outlets assessed their 2025 financial situation as strained but relatively stable. Revenues stayd more or less the same as in 2024 but news teams worked with barely any financial cushion and had to cut costs constantly, as evidenced by the anonymous quantitative online survey of journalists conducted by the Institute of Mass Information on 8 December 2025 through 5 January 2026. The survey was formatted as a questionnaire and included 193 journalists in all regions across Ukraine.*

Another 22% of the news outlets surveyed by IMI said their financial situation had become moderately worse in 2025. Revenues and salaries dropped, but the teams and output volumes remained largely intact.

IMI experts say that these two groups form the core of the Ukrainian media sector, which remains operational but is in a state of chronic financial precarity.

14% of news outlets reported a considerable deterioration of their financial situation, caused by the US grant cuts, in particular. These media outlets had to lay off part of their teams, produce less content, and abandon large formats (investigations, videos) despite formally continuing operations.

6% of the media surveyed by IMI were found to be in a critical state. These news outlets work while experiencing severe budget shortage, payment delays, and a real risk of shutdown.

Only 10% of the surveyed media outlets assessed their financial situation as stable or improving. They said they were almost completely independent of US grants to begin with, so the crisis that ensued after the funding programs were terminated had little to no impact on them.

1% of the surveyed media teams reported suspending or permanently ceasing operations in 2025 due to financial struggles, and 4% picked “Other”.

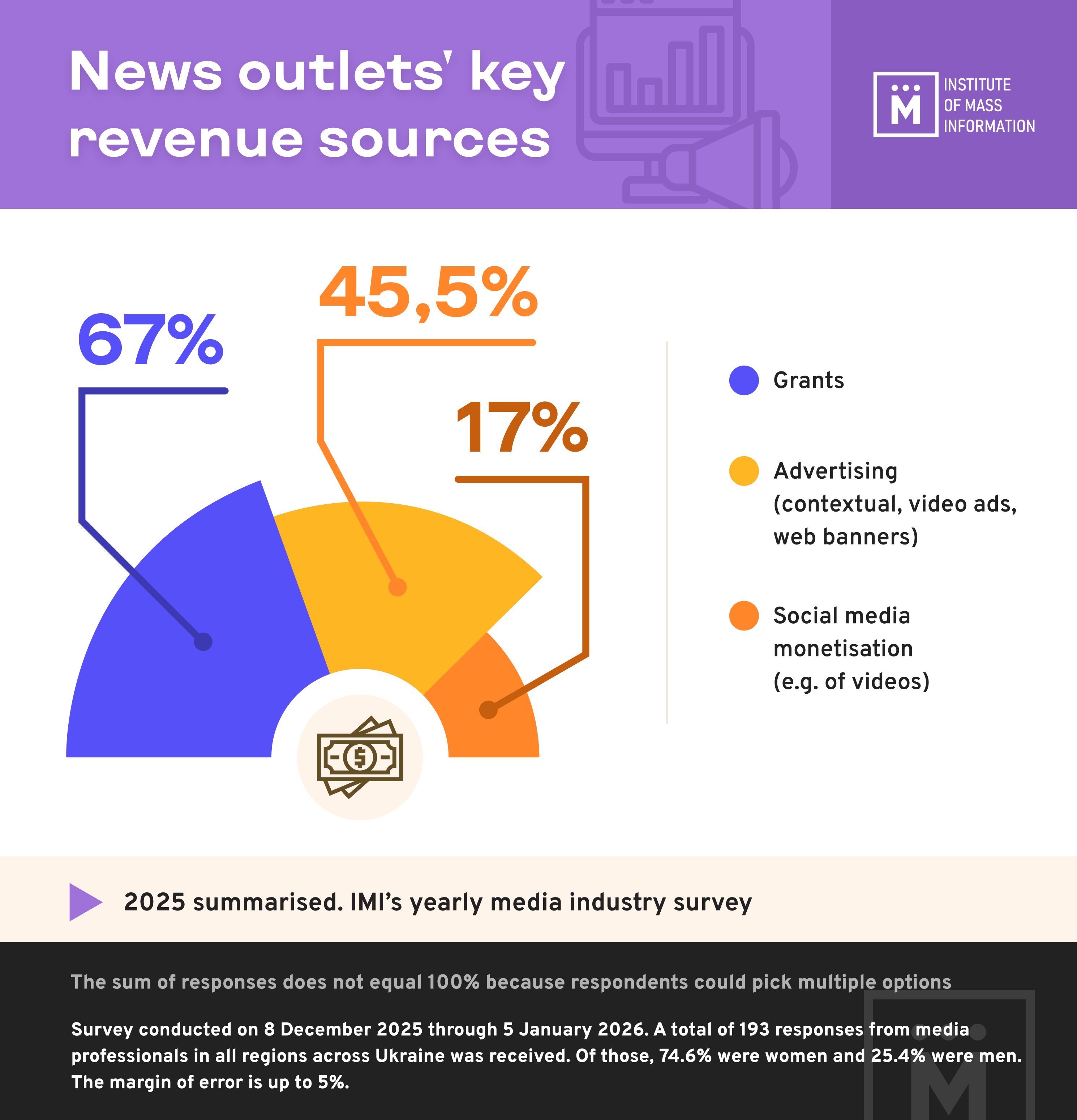

The survey also revealed news outlets’ funding models to be highly fragmented and unstable and the outlets themselves still critically dependent on external resources.

Most respondents (67%) mentioned grants as a key source of revenue. This indicates that grant support remains the Ukrainian media’s main pillar of financial support in wartime.

The second most commonly reported source of income was advertising (contextual, video ads, web banners): it was mentioned by 45.5% of respondents. However, these figures do not necessarily point to a full recovery of the advertising market, but rather to its fragmented presence in certain niches.

Social media monetisation (of videos in particular) ranked third among news outlets’ sources of revenues, mentioned by 17% of respondents. This suggest a shift in the traditional media’s focus towards social media platforms and the search for alternative sources of income outside the classic media model.

Native advertising, special projects, and state support (e.g. state commissions and grants) were mentioned as key sources of revenue by 16% of respondents each. Interestingly, 16.5% of news outlets said that their financial stability was ensured by their owners.

Voluntary contributions from the audience (donations, Patreon, bank fees) were mentioned as sources of income by 14.5%, and paid subscriptions and membership programs by only 12% of respondents, suggesting that the monetisation potential of membership programs is quite limited in wartime.

Commercial services and unlabelled political promotion remained the least commonly reported sources of income for the media (10% and 2.5% respectively), which correlates with the findings of IMI’s monitoring, which showed the presence of overt political promotion in the media to be relatively low**.

*The study was conducted using a quantitative anonymous online survey method with a simple random sample of potential respondents — journalists and news outlet editors. A total of 193 responses from media professionals in all regions across Ukraine was received. Of those, 74.6% were women and 25.4% were men. The margin of error is up to 5%. The survey was conducted on 8 December 2025 through 5 January 2026.

**The sum of responses does not equal 100% because respondents could pick multiple options.