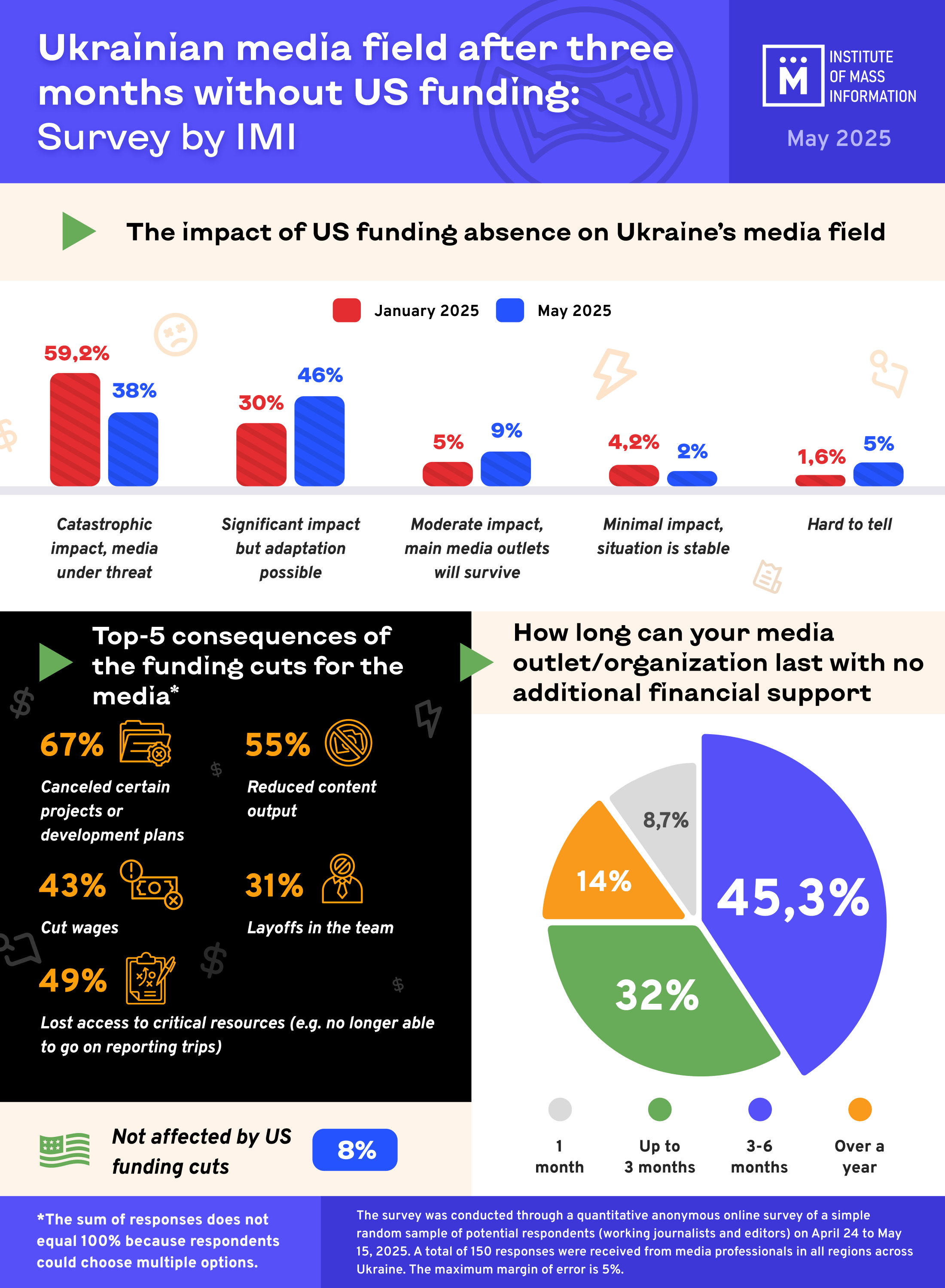

As of May 2025, most of the Ukrainian media outlets that used to receive grant support from the USA still have no stable sources of funding. Despite this, the media sector shows vitality and flexibility, searching for new sources of income and reducing expenditures. The levels of anxiety regarding the impact of US funding cuts on the media field among Ukrainian media professionals dropped in January–May 2025; however, the situation is still assessed as critical overall. The share of respondents who believed that the cessation of US funding would be catastrophic dropped from 59,2% to 38%. This suggests at least partial acceptance of the situation on the part of the journalist community, which felt a deep existential crisis in the first weeks following the funding cuts.

These are the findings of an anonymous quantitative online survey of Ukrainian journalists conducted via a targeted questionnaire on April 24 to May 14, 2025.*

The survey showed a shift towards more reserved assessments. The uptick in respondents who reported “Significant impact but adaptation possible” was the largest (+16%). While only 30% of media professionals were saying this in January, by May this figure grew to 46%. This suggests a gradual move from shock to acceptance and adaptation strategy by the media. Contrastingly, the share of those who believed that the situation was stable dropped (from 4,2% to 2%), which may mean that even the media outlets that felt confident in early 2025 are facing difficulties now.

How US funding cuts changed Ukraine’s media field. Diagrams by IMI

The decrease in panicked assessments does not necessarily suggest that the financial situation has improved: it is more likely to reflect an expansion in survival practices, which are not always positive. As the IMI survey showed, these range from switching to volunteer work to reducing the output of content, wage cuts, and layoffs. Ukrainian media may learn to persevere through extreme turbulence, but this comes at the cost of losing strategic development, focusing on survival only, and a drop in high-quality content, especially investigations and on-the-ground reporting.

How long the media will be able to last with no additional funding

The IMI survey recorded a movement towards relative growth in confidence in media outlets’ mid-term resilience. The number of respondents who reported they “can keep working for 3–6 months” has increased from 34,2% to 45,3%. This suggests that some media outlets have switched from “critical mode” (“We will last 3 months”) to “adaptation mode”: often thanks to internal mobilization, spending cuts, and temporary compensatory mechanisms (donations, local sources, savings, small bridge grants). The share of respondents who were confident their media outlets would survive for over a year nearly tripled (from 5,8% to 14%). This is a small but important group comprised mostly of national media outlets and media outlets based in Ukraine’s Western region, which likely have profitable work formats or stable internal budgets.

The number of respondents who reported they would “only last under 3 months” shrank by 5,5%, which suggests that some of the vulnerable teams either adapted or exited the market, not surviving until the May stage of the survey.

Some media outlets surveyed in January believed that US funding cuts would have no impact on their work. In May, no organization chose this response, which shows that even those who used to be confident in their autonomy have realized the scale of the crisis.

Despite the overall growth in confidence among many media outlets, the share of those literally “on the brink of closure” increased from 7,5% to 8,7%. The “will last 1 month only” category shows most acute vulnerability, as it signals a complete lack of a financial cushion. This means that a considerable percentage of media outlets have entered the “on the brink of closure” state. They likely have exhausted their internal reserves, were unable to use alternative sources of support or receive new grants, and were entirely dependent on US funding, which has ceased.

These changes do not prove that the situation has stabilized but rather point to a switch to survival strategy. This switch comes hand-in-hand with downsizing, forgoing development, minimizing the content output, and highlights the inequality between media outlets as bigger players continue working while smaller ones go extinct or merge with others. An increase in mid-term confidence does not compensate for the loss of dynamism, creative freedom, and institutional development of Ukrainian media.

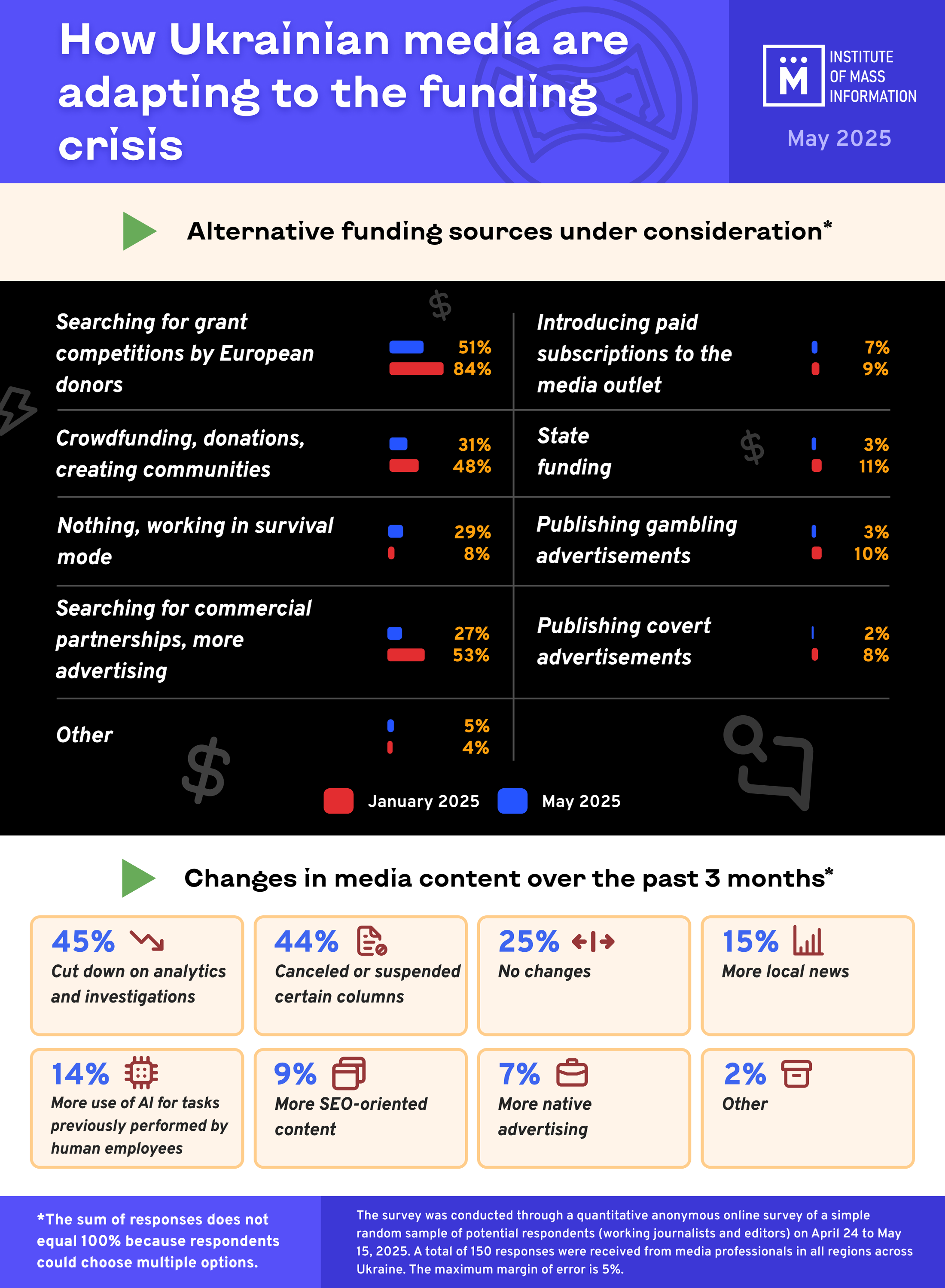

Financial strategy transformations among Ukrainian media (January–May 2025)

The IMI survey showed a collapse of expectations regarding external support among the media. The sharpest drop was in the number of media outlets that had hopes for three types of alternative funding, the first being grants from European donors: minus 33% in this category. 84% of the media professionals surveyed by IMI in January and only 51% of those surveyed in May hoped for these. Some media outlets saw no point in applying, some reported a lack of new grants on the market or said they did not have the resources to apply and compete.

Secondly, expectations of advertisement revenues or profits from commercial partnerships dropped by 26% (from 53% in January to 27% in May).

Finally, the hopes for crowdfunding support decreased as well: by 17% (with 48% of the surveyed media professionals expecting it in January and 31% in May). This suggests that the audiences have low spending power and that Ukraine has no culture of donating to the media. This may also hint at emotional burnout suffered both by media teams and the audiences.

The alarming category “In survival mode” grew the most: from 8% in January to 29% (+21%). This means that at least one third of the media has no strategy of searching for new funding sources. Essentially, this points to loss of strategy and managerial control, disillusionment, and a lack of financial prospects.

Notably, the share of those who had hopes for ethically dubious funding sources (covert advertisement, gambling businesses) shrank as well. It is likely that the availability of these sources and the amount of funding they offer proved to be significantly less than some respondents had expected.

Comparing January to May 2025 demonstrates deep demotivation among Ukrainian media in terms of funding. This includes decreased trust in external and internal sources, a loss of strategic optimism and a switch to survival mode by many. This is a sign of not just financial but emotional exhaustion in the sector.

How absence of US funding changed the Ukrainian media field

As the IMI survey showed, the main result was a functional crisis in the media and a structural deterioration of media outlets. In January, the media began cutting the “outer” expenses (offices, development plans, individual projects); in May, they went on to reducing the “core”: senses, people, wages.

How Ukrainian media are adapting to the funding crisis. Diagrams by the IMI

However, the share of those firing the staff shrank from 40% in January to 31% in May 2025. It appears that most layoffs happened earlier (the “first wave” effect) and media outlets were left with “bare-bones” teams that can not be downsized further.

A drop in the “Canceled office rent” category from 32% to 13% shows that this crisis management tool has been exhausted as well. Everyone who could switch to remote work had already done so by May.

The survey also revealed a new trend: a rise in volunteer work. As much as 15% of the surveyed media outlets switched to operating on a volunteer basis. This suggests extreme exhaustion of resources, where media outlets survive thanks to committed people who work without wages.

The survey showed that over a half of the media outlets (55%) reduced their content production capabilities. This may mean less news released every day; canceling projects, investigations, analytical reports; and switching to “economy mode”, that is, only preserving what is necessary to maintain the media outlet’s presence.

49% of the respondents lost access to critical resources (such as the ability to go on reporting trips). This is first and foremost a blow to on-the-ground reporting and investigative journalism, which are already rare in wartime. Without these resources, journalists become copy-pasters rather than witnesses to events.

43% of the respondents reported having to cut wages.

Most alarmingly, as many as 67% of the media outlets forwent development plans and new projects. This means no new plans, expansions, studies, campaigns. Only survival. One may call it strategic paralysis, as media outlets not just lack resources but also see no horizon to strive to.

8% of the media outlets resorted to non-transparent sources of funding such as covert advertising and gambling ads; IMI experts believe that this figure is likely to grow in the future. This is, essentially, media corruption that puts the ethical standards of journalism at risk. Ultimately, information manipulators win and both the media market and society lose.

Changes in content: what is gone, what is new

The survey shows that only 25% of the media outlets introduced no changes to their content in view of the financial crisis faced by the media market.

The reported changes are as follows**:

- 45% of the media outlets cut down on analytics and investigations; this can be viewed as a direct threat to public oversight and the transparency of the government.

- 44% cut down on certain types of content: feature articles, blogs, personal columns, human rights or culture-related sections. This entails a drop in content diversity and gradual loss of voice for various communities: young people, women, minorities, veterans, etc.

- 15% started engaging more with local content. On one hand, this is good (as it means support for local communities)—on the other, however, this may be a result of reduced opportunities to work on a broader scale, such as reporting on battlefield developments or interpreting national-level news for one’s home region.

- 14% expanded their use of AI in producing content to fill the gaps left after the layoffs. In this context, this may mean forced automatization caused by the loss of human employees rather than “digital transformation” and most likely includes AI-generated news, translations, rewrites.

- 9% now post more SEO-oriented content. This figure is not yet critical: there is no mass transformation of the media into “traffic farms” to speak of.

- 7% reported an increase in native advertising. This shows that the commercial market is in decline as well and most media outlets refrain from crass compromises even in the face of crisis.

In summary, Ukrainian media can be said to be experiencing slow erosion of content output. Analytical reporting is in decline, the content is becoming less diverse, some functions get relegated to AI. At the same time, there is no large-scale switch to toxic commercialisation: media outlets are choosing to shrink rather than sell out.

***

According to IMI’s annual survey, 80% of journalists made use of various forms of international support throughout 2024.

*The anonymous quantitative online survey of journalists was conducted via a targeted questionnaire on April 24 to May 15, 2025. 150 representatives of all types of media outlets based in all regions across Ukraine took part in the survey. The results were averaged by region and media outlet type to make the sample more representative. The survey takes into account the proportional shares of different media types in the overall structure of Ukraine’s media market (online, print, television and radio, social media pages of media outlets) as well as the geographical distribution of active media outlets by region. The assessment was carried out by applying the relevant coefficients to each group of respondents according to their share in the total sample.

**The sum of responses does not equal 100% because respondents could choose multiple options.

Attention! The results of this survey are compared with a similar one conducted by IMI immediately following the abrupt US funding cuts in January–February 2025. The comparison allows us to assess the shifts in media outlets’ expectations and their actions taken in response to the crisis, as well as to identify the degree to which the market has adapted to the new situation. It shows which crisis response mechanisms proved effective and which aspects of the situation deteriorated. This enables us to provide well-founded recommendations on supporting independent journalism for donors, the media community, and the state.